Jean Kovalevsky, astronome, spécialiste des satellites naturels et artificiels des planètes | Canal Académies

Applications of Computer Technology to Dynamical Astronomy: Proceedings of the 109th Colloquium of the International Astronomical Union, Held in Gaith a book by P. Kenneth Seidelmann and Jean Kovalevsky

Relativity in Celestial Mechanics and Astrometry: High Precision Dynamical Theories and Observational Verifications / Edition 1 by Jean Kovalevsky | 9789027721907 | Paperback | Barnes & Noble®

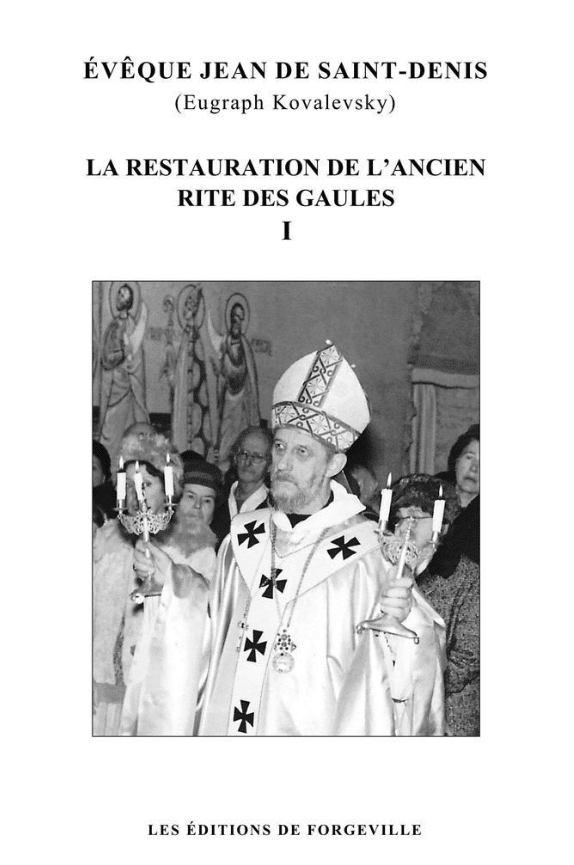

New books in French on Bishop Jean de Saint-Denis (Eugraph Kovalevsky) and the Gallican Rite – Western Rite Orthodox Information

Fundamentals of Astrometry: Kovalevsky, Jean, Seidelmann, P. Kenneth: 9780521173315: Amazon.com: Books

Introduction to Celestial Mechanics (Astrophysics and Space Science Library, 7): Kovalevsky, Jean: 9789401175500: Amazon.com: Books